What diffrentiates those who became financially free from everyone else?

Those who achieved success understand that it’s not only about earning more and diversifying thier income streams.

It’s actually about:

1- Adopting a savings mindset.

2- And using a reliable web app such as Nitsova.

That’s definitely the foundation for reaching your goal.

Think about it for a minute:

How can you build assets if you don’t know exactly how much money you are spending, how often and where you are spending it?

How can you become successful if you don’t understand your spending habits, identify issues and fix them?

Nitsova automatically generates lots of data to let you manage and plan your financials effortlessly.

It litterally takes care of everything for you.

Just get into the habit of saving each transaction on the go and watch the magic happen. That’s it.

It takes a few seconds to save an expense or income transaction (using a smartphone, laptop or any device).

It’s even faster than sending a text message.

WHY YOU NEED TO

TRACK YOUR EXPENSES

Being conscious of your expenditure is extremely important because it’s one of the earlier steps to understanding how you manage your finances. While it seems a difficult and complex task, it’s a piece of cake when you use our software.

❭ Financial Awareness Is Key

The main reason why people want to track their expenses is creating financial awareness, because even small everyday expenses can make you blow your budget. Without knowing where or how their money is spent, no one can understand what they need to change to save money. This is why millionaires are always aware of what they earn and what they spend. So if you want to be wealthy, you need to be aware of where you are spending money and what you can change to spend less and save more. This is how a person becomes rich and this is why you need to track your expenses.

❭ Easy To Find Spending Issues

You can identify serious spending issues only when you track your expenditure, and you can also determine whether your spending matches your priorities. Let’s say you eat out every night. So if you don’t track your spending, you can’t achieve your financial goals, because tracking allows you to identify where your money really goes. It is important when you want to make changes to your lifestyle and spending habits as it makes you realize when you need to stop spending.

❭ Never Exceed The Budget

If you want to save money, you need to stick to your budget. And for this, you need to track your money, because only after tracking your spending you will be able to stop spending on a category of items. If you consistently track your spending, you can make necessary changes and can even get rid of a debt. This will allow you to save money, become rich, and thus achieve all your goals and do what you like.

❭ Identify Habits That Cause Overspending

It’s tempting to stop when you overspend on some categories, but then the next month, you overspend on them again. Therefore, it’s important to track your expenses throughout the month so that you can identify what you need to change and how much you need to change it. A budget evolves over time to help you meet your needs and goals, and you can improve your budget by identifying which category you’re overspending on and whether you need to continue it or stop it.

❭ Quickly Identify Fraud

If you don’t’ keep track of your expenditure, credit card statements, or bank account, you can get fraudulent charges without even knowing it. Because it’s extremely painful to lose hard-earned money and it can even lead to bankruptcy, you need to track your card statement, bank account, and spending.

Double charges and auto-pay charges can easily be overlooked and sometimes not even being charged as usual. Therefore, keeping track of your expenses and financial information means you will be aware of where your money is, where it is going, and how you need to handle it.

❭ Ideal Strategy For Setting and Meeting Goals

When you know where your money is going, you can easily manage your finances and can set your financial goals, like that of saving a specific amount of money every week or having a new car. For instance, if a person wants to buy a new car in two months and they need 10,000 dollars for it, they would save 420 dollars every month. And you can make all these calculations when you track your finances and know where and how you’re spending your money.

❭ Always Be In Control

Tracking your expenses puts you in the driving seat of your finances. You know where your money is going and you know where to channel it. Plus, you don’t have to be a math genius to make the most of your tracking.

Tracking your expenditure can help you get rid of spending impulses, remove needless purchases, and realize what your money is worth. It not only saves you from debt but also helps you out from it if you’re in one. It helps you manage your money and allows you to be in total control of your finances.

❭ Summary

While tracking your expenses can help you save money, it can also help you set financial goals, because if you know where your money is going, you can easily make changes – start spending more or less – and identify any financial issue that you’re facing. It also gives insight into your impulses and spending habits, which will stick out as red flags when you track your expenditure.

USEFUL TIPS FOR YOU

Practical tips on how to keep track of your expenses:

❭ The Nitsova software is accessible from everywhere, from any device (computer, tablet, smartphone).

❭ So if you are using a Smartphone, you can create a shrotcut to it. That way, you enter every single transaction on the go.

❭ Keep receipts from aLL of your purchases.

Keep an eye on your bank statements, checkbook, online banking accounts, ATM/debit receipts, credit card statements, and refer to any bills that you’ve got.

❭ Save every purchase, no matter how small the amount you spent. Remember the little items because they can really add up!

❭ Nitsova is able to calculate totals and generate reports automatically.

❭ Nothing equals staying organised and keeping good habits on a daily basis!

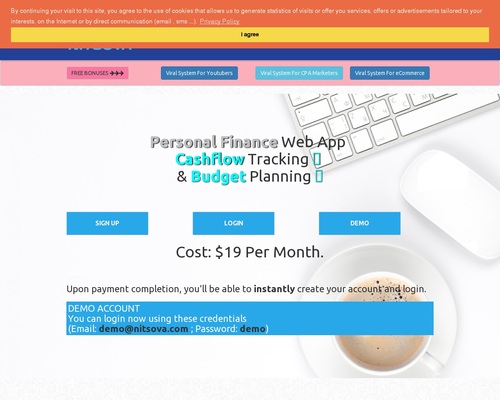

PRODUCT

Nitsova is a powerful online software that allows you to keep track of your income and expenses.

You can manage your budget and generate reports with a click of a button.

It is easy-to-use and it has an intuitive interface.

It is fully responsive, which means: mobile-friendly.

It is not required that you connect any of your bank accounts.